|

FEC

LegacyChange |

by Insured Grace Contract

Simplified Estate Asset Plans

LegacyChange.com Home

Save Tax

Insured-Economical-Efficient

Flexible Asset Transfer

Through a Non-Profit Asset

Transfer Organization

We do not market annuities or insurance, list real estate or businesses. We may, with client request or permission, refer to those who do.

|

by Insured Grace Contract Simplified Estate Asset Plans LegacyChange.com Home Save Tax Insured-Economical-Efficient Flexible Asset Transfer Through a Non-Profit Asset Transfer Organization |

|

|

Contact LegacyChange Phone: 800.333.0801 Free Consultation Appointment |

|

||||

|

LegacyChange &

&

&

& Minimize Conflict Plan

&

Divorce Settlement Plan

&

Family Farm Plan |

Reduce Tax Plus Guaranteed & Insured Income & Summarized Check List for Trustee & Will Executor Responsibility & & &

&

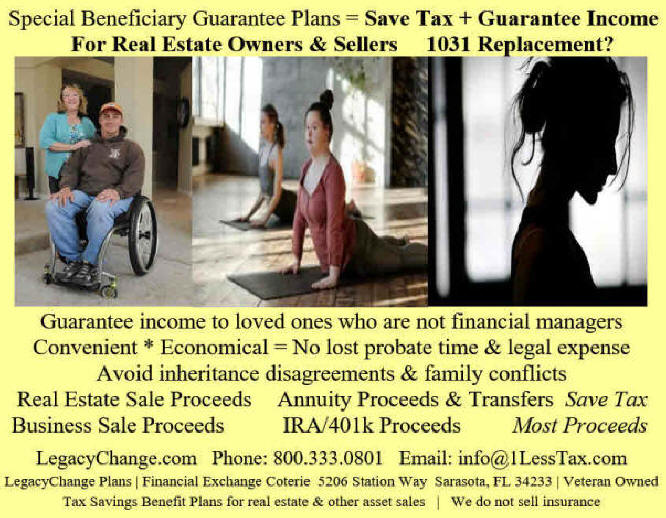

Special Needs Loved One Plan

&

Free Consultation

|

|||

Assure Moving Assets In Your Estate To Your Loved Ones,

Beneficiaries or Gift For Your Legacy without Inheritance Conflict

Maintain Efficient Guaranteed Income and Wealth from Assets

A LegacyChange Plan is a Preferred Method for Estate Planning

Efficient Asset Money Management

A Convenient Economical Special Beneficiaries Estate Plan

Go Here To Page To REGISTER For More Detail, Internet Informational Live Video

and/or Audio Dates & Times or Free CPA Consultation

&

Assisting to Preserve and Maintain Client Wealth

LegacyPlan

Basics

Grace or charitable bargain sale with installment contract (reinsured).

LegacyPlan acquires asset (by option contract)

LegacyPlan divests (sells) with non-profit tax advantages.

LegacyPlan pays seller with an insured installment contract.

Split interest transaction (multiple interest beneficiaries for non-profit)

&

Receive LegacyChange News and Updates Subscribe Here

More Tax Saving Alternatives at www.1LessTax.com See Page 3

Tax Reduction Service E-mail: info@1LessTax.com National: 800.333.0801

|

Minimizing Inheritance Conflict Advisory Page for Requesting Will Executor& Trust Trustee Responsibilities Documents Free Will Consultation & Discounted Trust by Experienced Local Estate Advisors LegacyChange vs Trust Incentive Plan

LegacyChange LegacyChange does not market annuities or insurance, list real estate or businesses. We may, with client request or permission, refer to those who do. LC programs are not available in Alabama, Alaska, Hawaii, and Maine LegacyChange, 1LessTax or 1031FEC do not provide tax or legal advice. Your CPA and Attorney recommended as advisers Irrevocable Perpetual Trust at www.EternalLegacyTrust.com For Tax Updates and News on Facebook View @1LessTax

C.P.R.E.S

“Booneisms”: “A fool with a plan can beat a genius with no plan”. Copyright © 2018-2022 K. B. Wheeler Jr. All rights reserved 3-10 5-D 6 7 |