|

FEC

LegacyChange by Insured Grace Contract Simplified Estate Asset Plans LegacyChange.com Home Save Tax Insured-Economical-Efficient Flexible Asset Transfer Through a Non-Profit Asset Transfer Organization |

|

Return to LegacyChange Home Page

Special Beneficiaries Income Plan

Asset Transfer - Non-Tax Burden - Gifting Legacy - Keep Planning Private

Minimize-Prevent inheritance disagreements & Family conflict before you need the following

&

Check List: Trustee & Will Executor Responsibility (PDF) - Summarized

(When Desired, Ask for More Complete Responsibility Document)

&

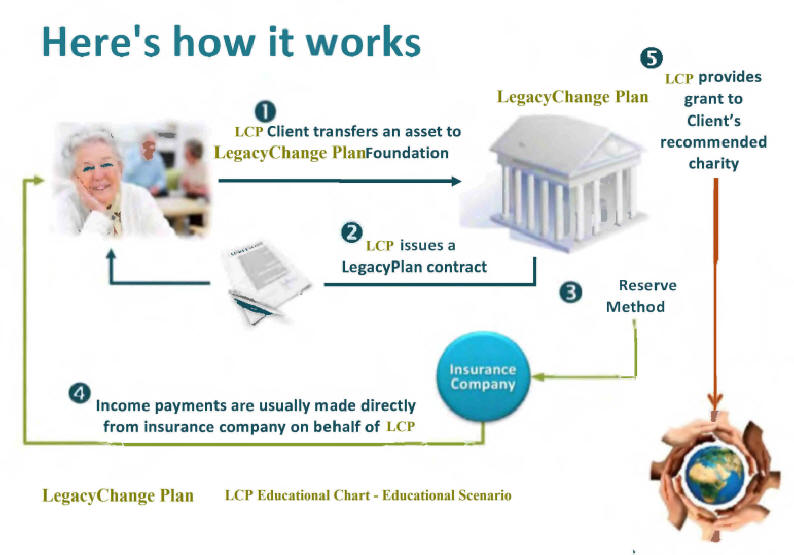

How It Works

Assisting to Preserve and Maintain Client Wealth

LegacyPlan

Basics

Grace or charitable bargain sale with installment contract (reinsured).

LegacyPlan acquires asset (by option contract)

LegacyPlan divests (sells) with non-profit tax advantages.

LegacyPlan pays seller with an insured installment contract.

Split interest transaction (multiple interest beneficiaries for non-profit)

&

Request Free Consultation and/or PDF Documents Here

|

LegacyChange (LC) has the expertise and administrative capabilities to assist charities and non-profits in two ways:

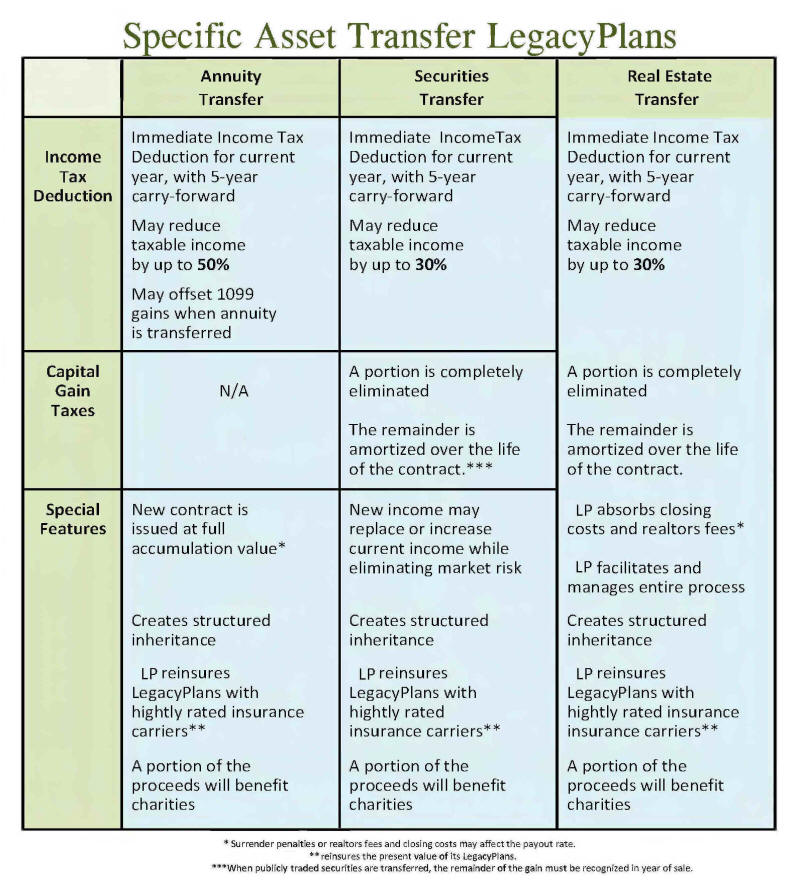

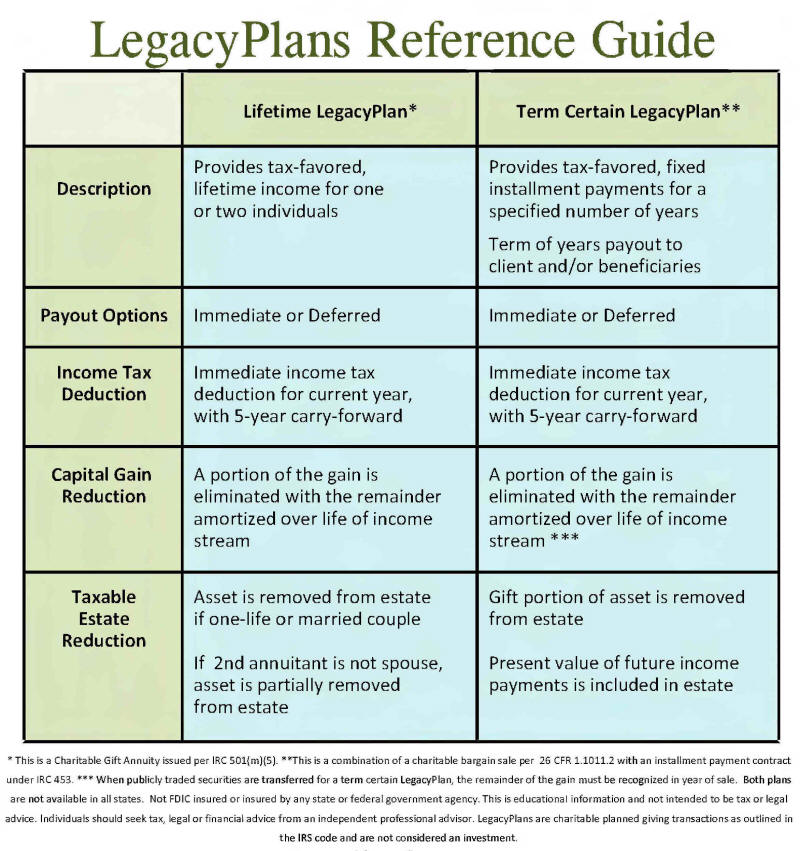

LegacyChange Plans include immediate and deferred charitable gift annuities (CGAs) and charitable bargain sales with installment contract payouts (CBICs), as well as simple charitable remainder annuity trusts (CRATs). LCP secures the reinsurance contracts to back the obligation Utilizing your Indexed, Fixed, or Variable Annuity for a LegacyPlan will allow you to achieve a number of objectives.

Here’s how it works for annuities, securities and various assets:

&

LegacyChange Plans (LCP) offer simplified charitable planned giving programs that we call "LegacyPlans", which enable families and individuals to reposition assets that they already own, such as securities, real estate and existing annuities, in order to create new benefits for themselves and their heirs. These include generating an income tax deduction, reducing capital gains taxes and estate taxes, creating an income stream for themselves or their heirs, while supporting their favorite charitable causes. By working through a 501 (c)(3) non-profit organizations, ordinary families are able to benefit from provisions in the tax code that many thought were only available to very wealthy individuals. The chart below summarizes the features and benefits of LTF’s two most popular LegacyPlans.

Return to LegacyChange

All diagrams and detail therein are scenarios to be updated and adjusted to each plan's individual requirement. This is educational information and is not intended to be legal or tax advice. Individuals should seek tax, legal or financial advice from an independent professional advisor.

*IRC

§501(m)(5) *** When transferring publicly traded securities, remainder of gain must be recognized in year of sale. Both products are not available in all states. Not FDIC insured or insured by any federal or state government agency. |

&

&

Return to LegacyChange Home Page

Go to Incentive Plan

&

Assisting to Preserve and Maintain Client Wealth

Asset Transfer - Non-Tax Burden - Gifting Legacy

Business Entry-Management-Exit

Plans - BEME

Tax Reduction Services - Legal - Estate

- Tax

Contact Us

Receive Legacy Change News and Updates Subscribe Here

For Tax Updates and News on Facebook View @1LessTax

E-mail National: 800.333.0801

Minimizing Inheritance Conflict

Free Will Consultation & Discounted Trust by Experienced Local Estate Advisors

More Tax Saving Alternatives at www.1LessTax.com See Page 3

Go here To Page To REGISTER For More Detail, Internet Informational Meeting

and/or Informational Class Date-Place

Free Consultation & Discounted Experienced Local Estate Advisors

Advanced Asset Funding for Heirs Go Here: Cash Advance

Return to LegacyChange Home Page

Tax and Legal Advisers always recommended. We can assist finding attorney.

Not all programs are available in every state. LC does not provide tax or legal advice.

LegacyChange Plans are not FDIC insured or Investments

We do not market annuities or insurance, list real estate or businesses. We may, with client request or permission, refer to those who do.

C.P.R.E.S

Contact LegacyChange Phone: 800.333.0801

Copyright © 2018-2022 K. B. Wheeler Jr. All rights reserved 3-10 5-D 6